vermont sales tax rate 2021

The Burlington sales tax rate is. Learn about Vermont tax rates rankings and more.

The States With The Highest Capital Gains Tax Rates The Motley Fool

312 a applicable to the states major tax sources and provide.

. The Vermont tax rate is unchanged from last year however the income tax brackets increased due to the annual. The 2022 state personal income tax brackets are updated from the Vermont and Tax Foundation data. Location Option Sales Tax.

Vermont wants sales taxes for groceries. This is the total of state county and city sales tax rates. Explore data on Vermonts income tax sales tax gas tax property tax and business taxes.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. Vermont has state sales. States have an additional capital gains tax rate between 29 and 133.

The range of total sales tax rates within the state of Vermont is between 6 and 7. July 22 2021. Local jurisdictions can impose additional sales taxes of 1.

Exemptions to the Vermont sales tax will vary by state. The state sales tax rate in Vermont is 6. 31 rows The state sales tax rate in Vermont is 6000.

Sales Tax Rates in Major Cities Midyear 2021. Look up 2021 sales tax rates for Strafford Vermont and surrounding areas. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US.

As of January 1 2021. Employers pay two types of unemployment taxes. Tax rates are provided by Avalara and updated monthly.

A recent bureaucratic report recommends expanding Vermonts sales tax to include food groceries electricity and clothing. The minimum combined 2022 sales tax rate for Burlington Vermont is. This 2021 Vermont Tax Expenditure Report is a continuing effort to catalogue all exemptions exclusions deductions credits preferential rates or deferral of liability as defined in 32 VSA.

Use tax is also collected on the consumption use or storage of goods in Vermont if sales tax was not paid on the purchase of. 2021 Vermont State Sales Tax Rates The list below. State unemployment taxes are paid to this Department and deposited into a trust fund that can only be used for the payment of benefitsThe state tax is payable on the first 15500 in wages paid to each employee during a calendar year.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Vermont Percentage Method Withholding Tables for wages paid in 2020. State State Sales Tax Rate Rank Avg.

In total the buyer would be responsible for paying 2675 in Vermont. The rates listed below are either 2021 or 2020. Simplify Vermont sales tax compliance.

6 Vermont Sales Tax Schedule. Local Sales Tax Rate a. State and Federal Unemployment Taxes.

Meanwhile total state and local sales taxes range from 6 to 7. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. 9 Vermont Meals Rooms Tax Schedule.

Purchase and Use Tax 32 VSA. Vermont tax forms are sourced from the Vermont income tax forms page and are updated on a yearly basis. The Vermont sales tax rate is currently.

Then the second 150000 would be taxed at 145 which comes to 2175. March 1 2021. Vermont state does have local sales tax so the total sales tax rate could include a combination of state county city jurisdictions and district tax rates.

Vermont is a destination-based sales tax state. Compare Tobacco Tax Data in Your State. Local Option Alcoholic Beverage Tax.

Purchase and Use Tax is due at the time of registration andor title at a percentage of the purchase price or the National Automobile Dealers Association NADA clean trade-in value whichever is greater minus the value of the trade-in vehicle or any other allowable credit. A majority of US. A financial advisor in Vermont can help you understand.

The County sales tax rate is. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. Average Sales Tax With Local.

Average Local Sales Tax Rate. Meaning you should be charging everyone in your state the rate where the item is being delivered. The state of Vermont levies a 6 state sales tax on the retail sale lease or rental of most goods and some services.

Local Option Meals and Rooms Tax. On this home the home buyer would pay 05 of 100000 which would come to 500. If the vehicle is currently registeredtitled to you or your.

With local taxes the. 5 rows 2021 Vermont State Salary Examples.

State Corporate Income Tax Rates And Brackets Tax Foundation

State By State Non Collecting Seller Use Tax Guide

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

States With Highest And Lowest Sales Tax Rates

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Cell Phone Taxes And Fees 2021 Tax Foundation

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Vermont Income Tax Calculator Smartasset

Is It Possible To Buy A New Apple Device Without Any Sales Tax Appletoolbox

Sales Tax By State Is Saas Taxable Taxjar

Sales Tax Definition What Is A Sales Tax Tax Edu

Sales Taxes In The United States Wikiwand

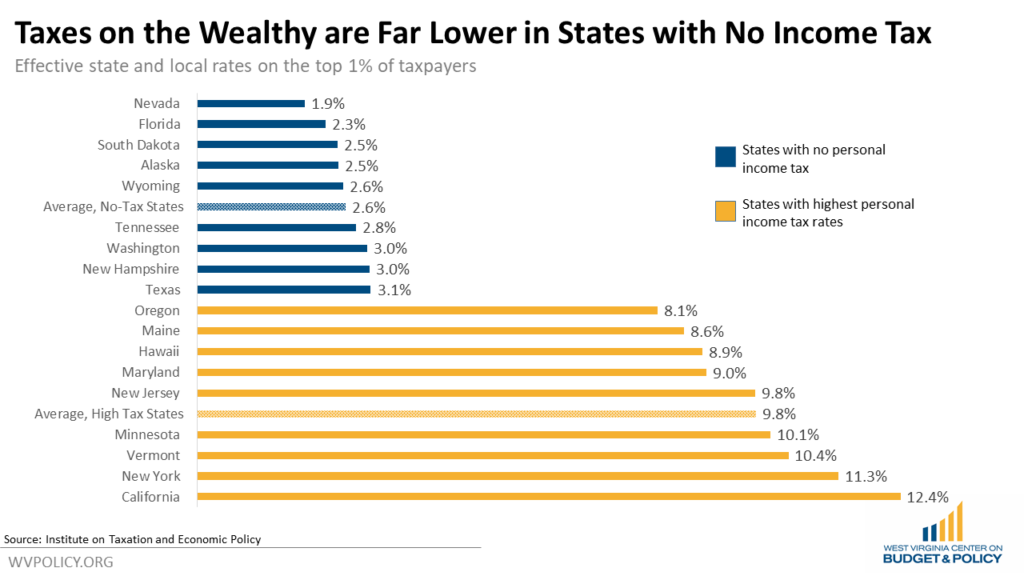

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy

Liqour Taxes How High Are Distilled Spirits Taxes In Your State